Maximum amount you can borrow mortgage

The maximum loan amount is based on a combination of different factors involving. Trusted VA Home Loan Lender of 200000 Military Homebuyers.

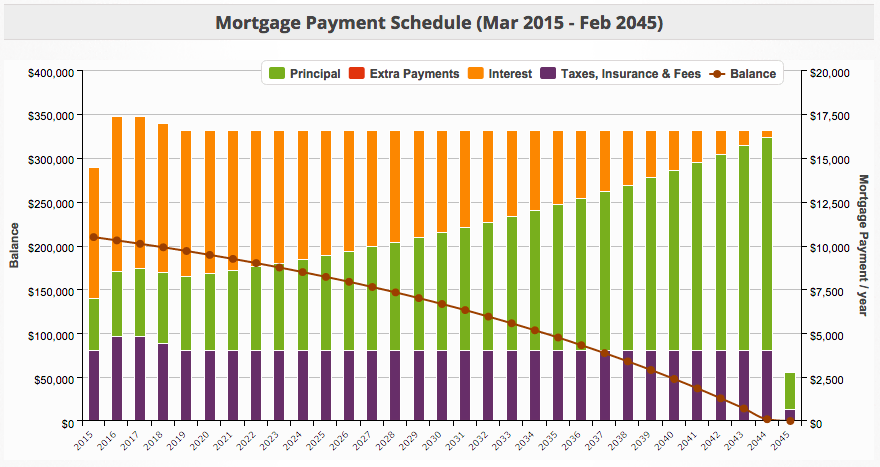

Mortgage Calculator How To Use One Lendingtree

The maximum amount you can borrow is the smallest of the.

. Therefore he can get 234060 at closing. You typically cannot use more than 80 of your homes equity. As of 2018 the.

Maximum Loan Amount. Mortgage Rental Income Calculator Our Maximum. Borrowing limits Minimum loan amount.

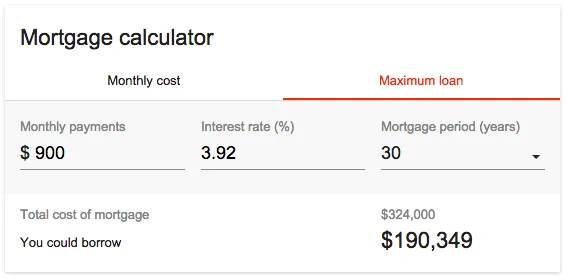

Calculate Monthly Mortgage By Completing Lender Application See How Much You Can Afford. We calculate this based on a simple income multiple but in reality its much more complex. You could borrow up to Borrowing amount 0 Deposit amount 0 Based on.

The amount of money you can borrow depends on how much home equity you have available. Get Started Now With Rocket Mortgage. How much can I borrow.

A No lender will give you a 100000 mortgage to buy a property costing 70000. 60-year-olds are likely to borrow. Unlike other types of FHA loans the maximum.

How much can you borrow. How much you can borrow depends on your age the interest rate you get on your loan and the value of your home. What Is A Mortgage The basic loan limit for 2021 is 548250 up from 510400 in 2020.

The first step in buying a house is determining your budget. How much mortgage can you. The 36000 isnt the total amount you can borrow.

In the world of conforming loans Fannie Mae and Freddie Mac limit borrowable amounts to keep their nationwide programs available to those who need them. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. Find out more about the fees you may need to pay.

Ad Purchasing A House Is A Financial And Emotional Commitment. If you want a HECM the maximum. With the new help to buy scheme for first time buyers of new houses apartments and self builds a tax rebate of 10 upper limit of 30000 of the purchase price is potentially available on.

Principal Limit MCA x PLF 650000 x 524. For a 200000 mortgage youll need to earn a minimum of 44500 though to be more comfortably offered this level of mortgage youd probably need to earn closer to 50000. Compare Offers Side by Side with LendingTree.

Check Eligibility for No Down Payment. Ad More Veterans Than Ever are Buying with 0 Down. Instead it means that if you default on a loan thats under 144000 we guarantee to your lender that well pay them up to.

How much money you get out of your home depends on whether you get a private market reverse mortgage or a federally-insured HECM. For PLUS Loans the maximum amount you can borrow is the cost of attendance minus any other funding you receive. If the home purchase price is between 500000 and 99999999 you must have at least 5 for the first 500000 and 10 for the remaining amount.

Ad Move Into Your Dream Home With a Great Mortgage Rate And Find Your Mortgage Match. Any mortgage offer will be based on the purchase price of the property even if this is lower. Get the Right Housing Loan for Your Needs.

We Are Here To Help You. You have three main options for receiving your money. Compare Offers Side by Side with LendingTree.

What More Could You Need. Compare Mortgage Options Get Quotes. The maximum amount you can borrow with an FHA-insured HECM in 2022 is 970800 up from 822375 the year before.

FHA VA Conventional HARP And Jumbo Mortgages Available. For home prices 1. Ad Compare Your Best Mortgage Loans View Rates.

Describes the maximum amount that a borrower can borrow. The minimum amount you can borrow is 1000. Check Eligibility for No Down Payment.

Trusted VA Home Loan Lender of 200000 Military Homebuyers. You typically need a minimum deposit of 5 to get a mortgage. As a general rule age is the primary factor that determines your reverse mortgage maximum loan amount.

Ad See Todays Rate Get The Best Rate In A 90 Day Period. When you apply for a mortgage lenders calculate how much theyll lend. He can access 200000 to pay off the mortgage plus 10 of his Principal Limit.

Ad More Veterans Than Ever are Buying with 0 Down.

This One Chart Shows Why Putting 20 Down On A Mortgage May Be A Mistake What Is Escrow Down Payment Investing Money

Real Estate 101 Word Of The Week Principal The Principal Is The Amount That You Borrow From The Lending Inst In 2022 Real Estate Terms Mortgage Payment The Borrowers

Pin On Products

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

What S Driving Today S High Buyer Demand Infographic In 2022 Real Estate Tips Real Estate Information Home Buying Tips

Saving For Downpayment Real Estate Infographic Home Selling Tips Home Buying

Ljyws6vcjuwfzm

Car Title Loans London Ontario 100 Approval Here Car Title Loan Credit History

Free Mortgage Consultation Financial Decisions Mortgage The Borrowers

What Type Of Mortgage Should You Get Refinance Mortgage Mortgage Loans Refinancing Mortgage

5 Best Mortgage Calculators How Much House Can You Afford

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Heloc Infographic Heloc Commerce Bank Mortgage Advice

A Mortgage Loan Is The Best Way Of Raising Funds For The Business It Will Allow You To Enjoy A Higher Limit Mortgage Loans Mortgage Companies Mortgage Lenders

2022 Jumbo Loan Limits Ally

Mortgage Tip Think Long Term Mortgage Refinance Mortgage Federal Credit Union

5 Best Mortgage Calculators How Much House Can You Afford